38+ 30 year mortgage amortization schedule

The monthly loan payment is determined by the loan amount interest rate and terms. For a fixed rate mortgage building an amortization schedule is much simpler thanks to the locked.

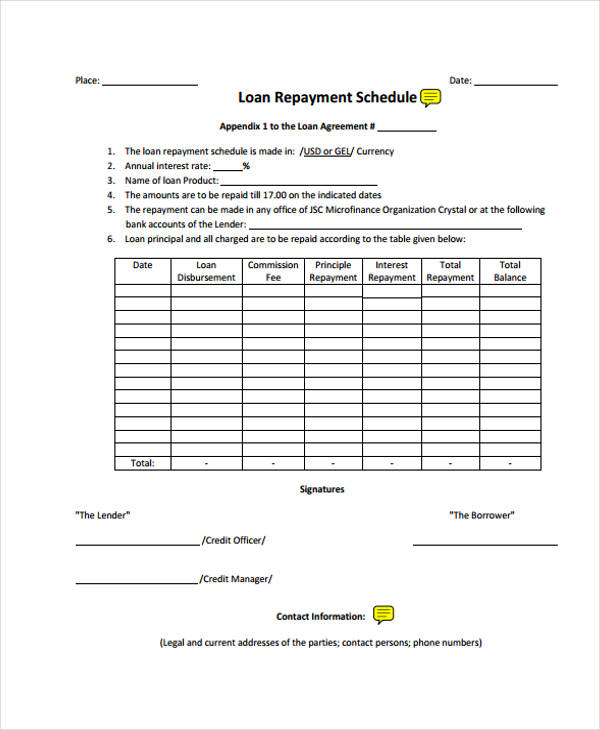

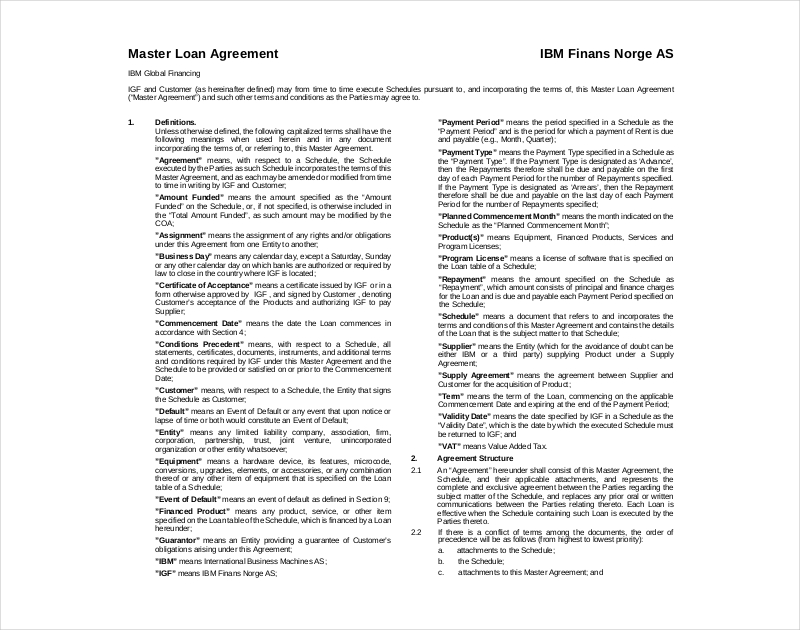

Loan Payment Schedule Amortization Schedule Loan Repayment Schedule Schedule Template

Use our calculator above.

. 30 year amortization schedule. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Current 3-Year Hybrid ARM Rates. Second mortgage types Lump sum. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years.

This data is based on Housing Finance at a Glance. 30 Year Mortgage Calculator Condo Mortgage Calculator Coop Mortgage Calculator. Biweekly Mortgage Calculator With Amortization Schedule.

Assuming you have a 20 down payment 80000 your total mortgage on a 400000 home would be 320000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1437 monthly payment. A 30-year mortgage comes with a locked interest rate for the entire life of the loan. The payment on the hypothetical 15-year loan is 2108 676 or about 38 more than the.

Second mortgages come in two main forms home equity loans and home equity lines of credit. On a fixed interest loan or a 30-year fixed. A 15-year fixed mortgage sits at 538 a 296 rise.

Biweekly mortgage calculator with amortization schedule is a home loan calculator to calculate biweekly payments for your mortgage. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. Brets mortgageloan amortization schedule calculator.

This is because loans with longer terms come with cheaper monthly payments. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Need a sample amortization schedule for a 30-year fixed mortgage.

Example table for a loan which began in November of 2022 with extra payments beginning 2 years later. Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage. However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time.

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page. The loan is secured on the borrowers property through a process. It is the second most purchased type of mortgage product next to 30-year fixed-rate loans.

For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year. Payment 38 95483 62891 32592 Nov-6-2025 Payment 39 95483 62782 32701. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Divide the rate of interest 5. The period for the return of the loan is settled as 30 years with an outstanding loan balance of 350000 US. Most homebuyers choose a 30-year fixed-rate mortgage but a 15-year mortgage can be a good choice too.

Almost any data field on this form may be calculated. But you may also obtain 20-year 15-year and 10-year terms. This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage.

Loan Original Amount 1st Year Start of Extra Payments. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. As for payment terms the most common ones are 30-year terms.

This allows you to secure a lower rate and pay your mortgage earlier. And a 15-year and 30-year loan at todays. Extra payments allow borrowers to pay off their home mortgages or personal loans faster.

NerdWallets mortgage amortization schedule calculator can help you do all of those things. If your current rate on a 30-year fixed loan is 4000 would you like to see if you can get it lower. Amortization Schedule with Extra Payments.

Annual Interest Rate. Build home equity much faster. As for 30-year fixed-rate mortgages Urban Institute reported that it.

Then once you have calculated the payment click on the Printable Loan Schedule button to create a printable report. A loan or mortgage amortization schedule is a table that shows borrowers their monthly loan payments. You can then print out the full amortization chart.

The biweekly loan calculator has a biweekly amortization schedule excel that breaks down all the payment details. To help you see current market conditions and find a local lender current Redmond 15-year and current Redmond 30-year mortgage rates are published in a table below the. Fere is a perfect guide on printable amortization schedule and loan amortization schedule excel.

For a better look at how your 30-year mortgage will be paid off over time your lender will provide an amortization schedule. If a person. Because the rate stays the same expect your monthly payments to be fixed for 30 years.

By making extra payments on a regular basis or a large one-time lump sum payment toward principal may save a borrower thousands of dollars in interest payments and may even cut a few years of the loan terms depending on the size of. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Amortization Schedule - The borrower can view the HELOC amortization schedule monthly or annually. Annual Amortization Schedule for Your 260000 Home Loan With Extra Payments. You can get information about extra payments annual amortization mortgage.

The following table shows the rates for ARM loans which reset after the third year. 15 Year Amortization Schedule is a loan calculator to calculate monthly payment for your fixed interest rate 15-year loan with a 15 year mortgage amortization schedule excel. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1.

People typically move homes or refinance about every 5 to 7 years. A Monthly Chartbook released in June 2020. 30-Year Fixed Mortgage Principal Loan Amount.

By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187.

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 56 Loan Agreement Forms In Pdf Ms Word

Free 9 Loan Spreadsheet Samples And Templates In Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

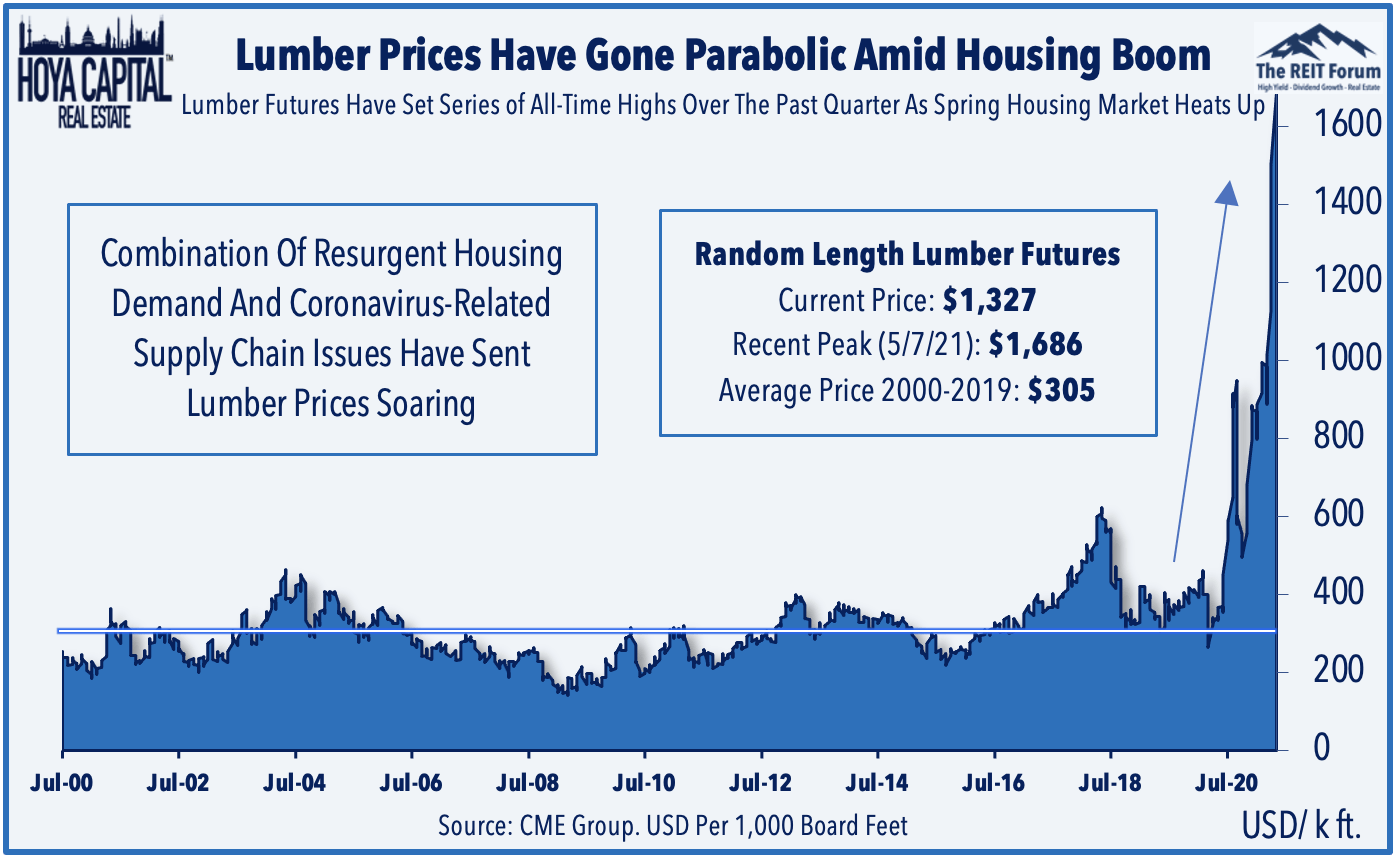

Timber Reits Lumber Shortage Inflames Seeking Alpha

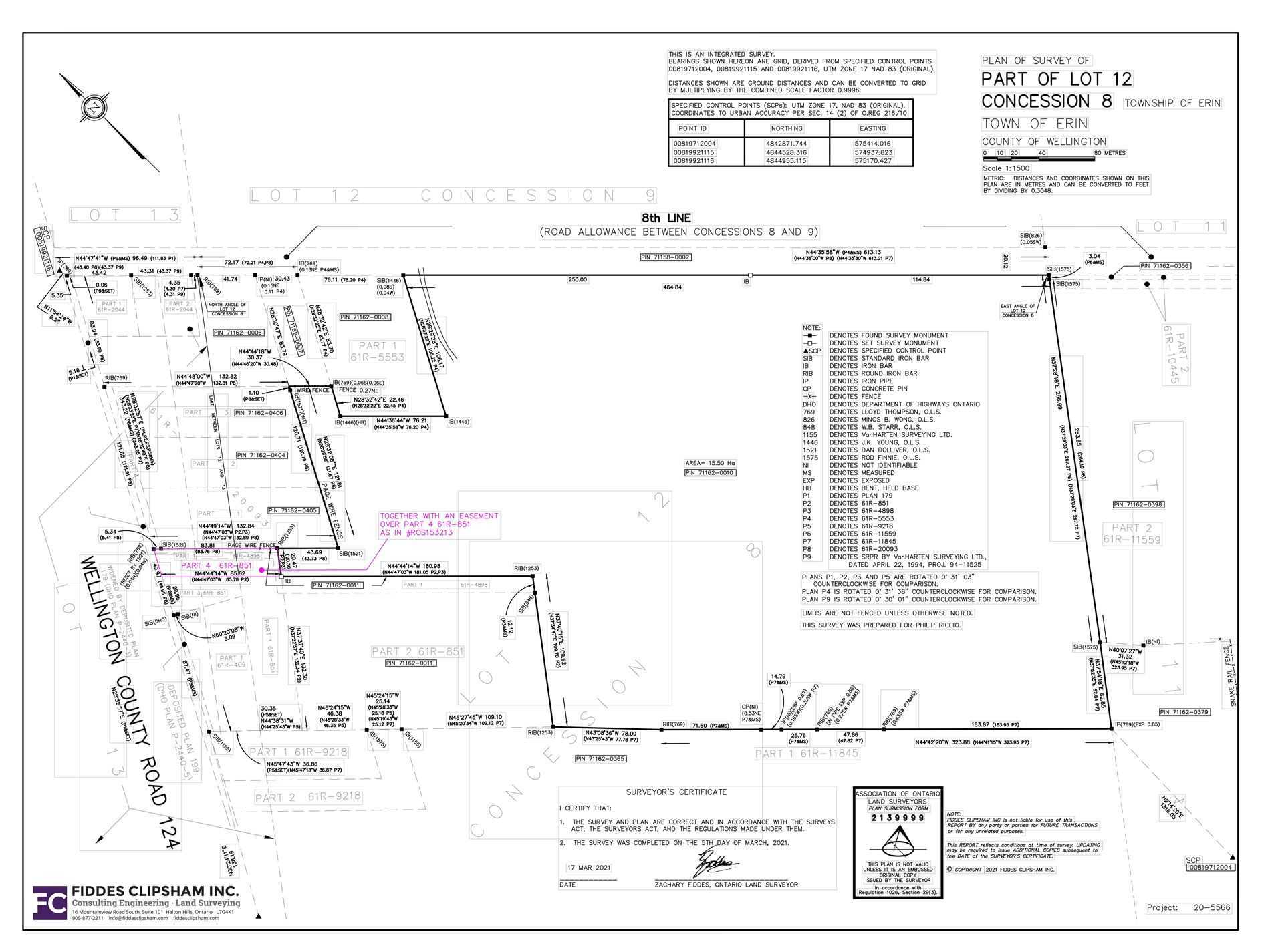

5356 Eighth Line Erin On Land Lot For Sale Rew

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Free 9 Loan Spreadsheet Samples And Templates In Excel

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Free 9 Loan Spreadsheet Samples And Templates In Excel

5356 Eighth Line Erin On Land Lot For Sale Rew

Loan Agreement 21 Examples Format Pdf Examples

How Long Does It Take To Repay A Loan Of Around 35 Lakhs After Doing A Pgp From Isb Hyderabad Mohali Is It Worth It Quora

Loan Amortization Schedule Simple Amortization Schedule Schedule Template Excel Templates

Free 12 Rate Sheet Templates In Pdf

Free 11 Mortgage Broker Business Plan Samples In Google Docs Ms Word Pages Pdf

Free 9 Loan Spreadsheet Samples And Templates In Excel